Press release - Veldhoven, the Netherlands, November 16, 1999

ASM Lithography Holding NV (ASML) announces that it intends, subject to market and other conditions, to raise approximately $400 million (excluding proceeds of an over-allotment option, if any) through a private offering of convertible subordinated notes due 2004 to certain qualified institutional investors. No other terms were disclosed. The company stated that it intends to use net proceeds from this offering to fund capital expenditures, to support increases in working capital related to anticipated increases in sales and production volumes and to fund the Company's continuing research and development program as well as the investment in new technologies and business lines consistent with the Company's objective of providing leading edge imaging solutions. The securities to be offered will not be registered under the Securities Act of 1933, as amended, or applicable state securities laws, and may not be offered or sold in the United States absent registration under the Securities Act and applicable state securities laws or available exemptions from such registration requirements. This news release does not constitute an offer to sell or the solicitation of an offer to buy the securities. Any offer of the securities will be made only by means of a private offering memorandum.

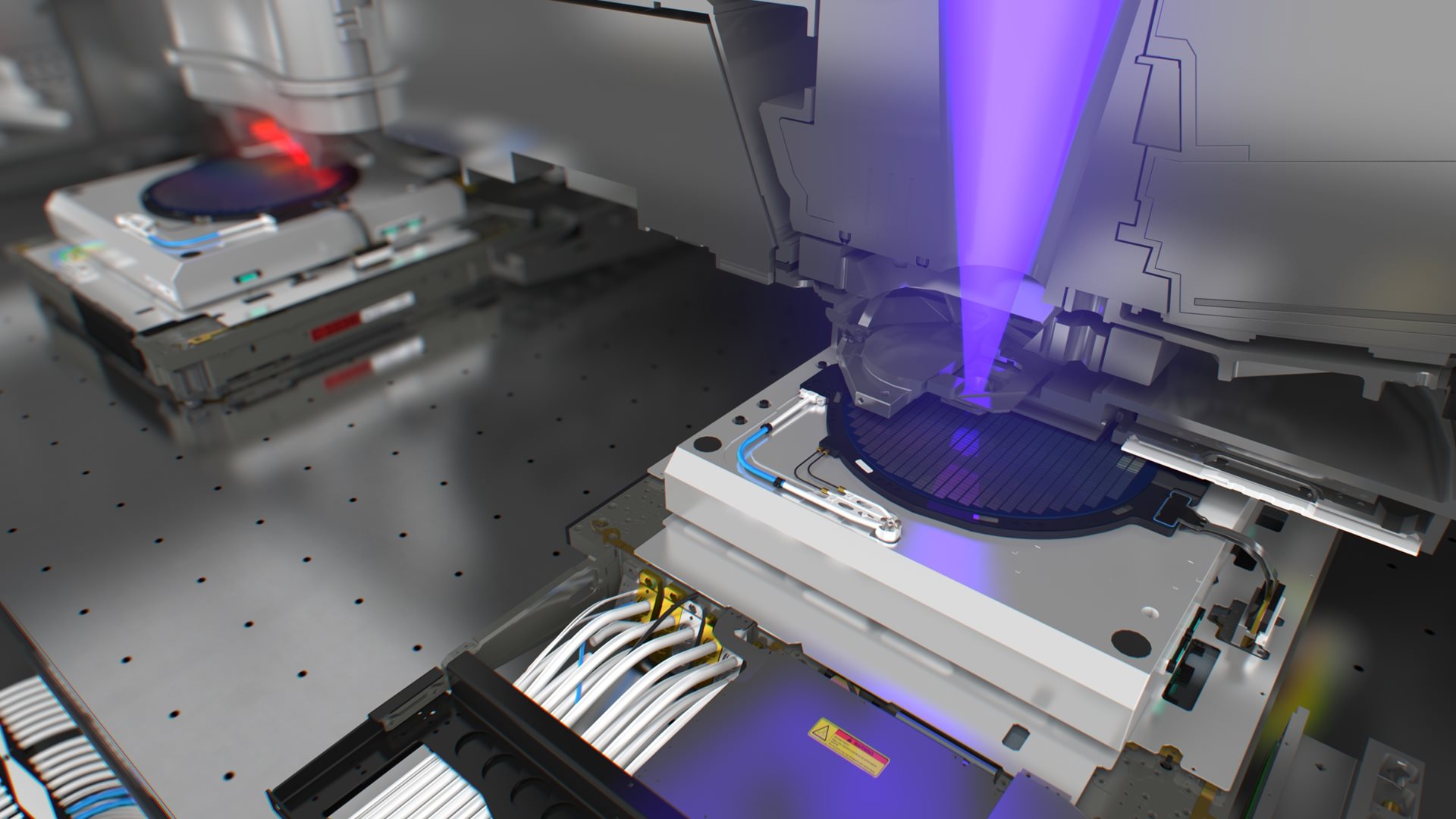

About ASML