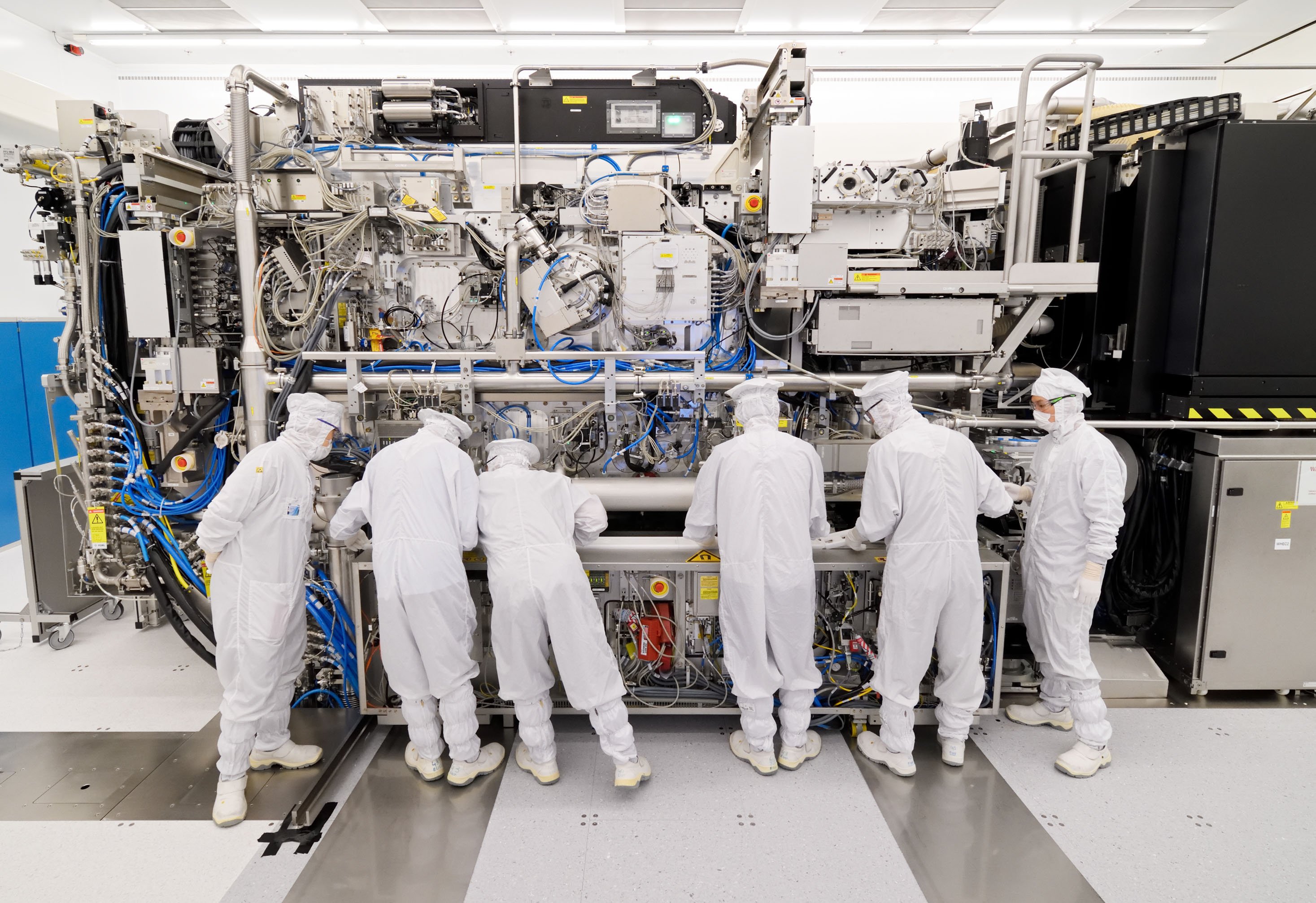

Lithography is at the heart of the semiconductor industry.

Over the last 30 years, we have utilized our unique balance of experience and innovation to evolve with the needs of this growing industry and build a strong value-added business for all our stakeholders.

We have the right tools in place to execute our long-term financial strategy and expect to achieve continued sustainable growth for the years ahead.

Big trends = sizable growth

Technology is changing fast. Some 175 zettabytes of data will be created annually by 2025.

This volume of data could not be realized without the relentless drive of the semiconductor industry to improve the performance of computer chips while reducing their cost.

While the world’s most advanced logic and memory chips are powering high-end trends in artificial intelligence, Big Data and automotive technology, the simpler, low-cost chips are integrating sensing capabilities in everyday technology to create a vast Internet of Things.

In short, the global semiconductor market will continue to grow exponentially for the coming years.

This translates into growth of worldwide fab capacity in all segments, especially at the leading-edge nodes. This provides a long-term growth opportunity for ASML as we continue to meet the semiconductor industry’s demand for higher productivity, lower cost, and simpler chip-making processes.

Based on the different market scenarios, as presented during our November 14, 2024 Investor Day we believe we have an opportunity to reach annual sales of between approximately €44 billion and €60 billion in 2030, with a gross margin between approximately 56% and 60%.

Expediting EUV

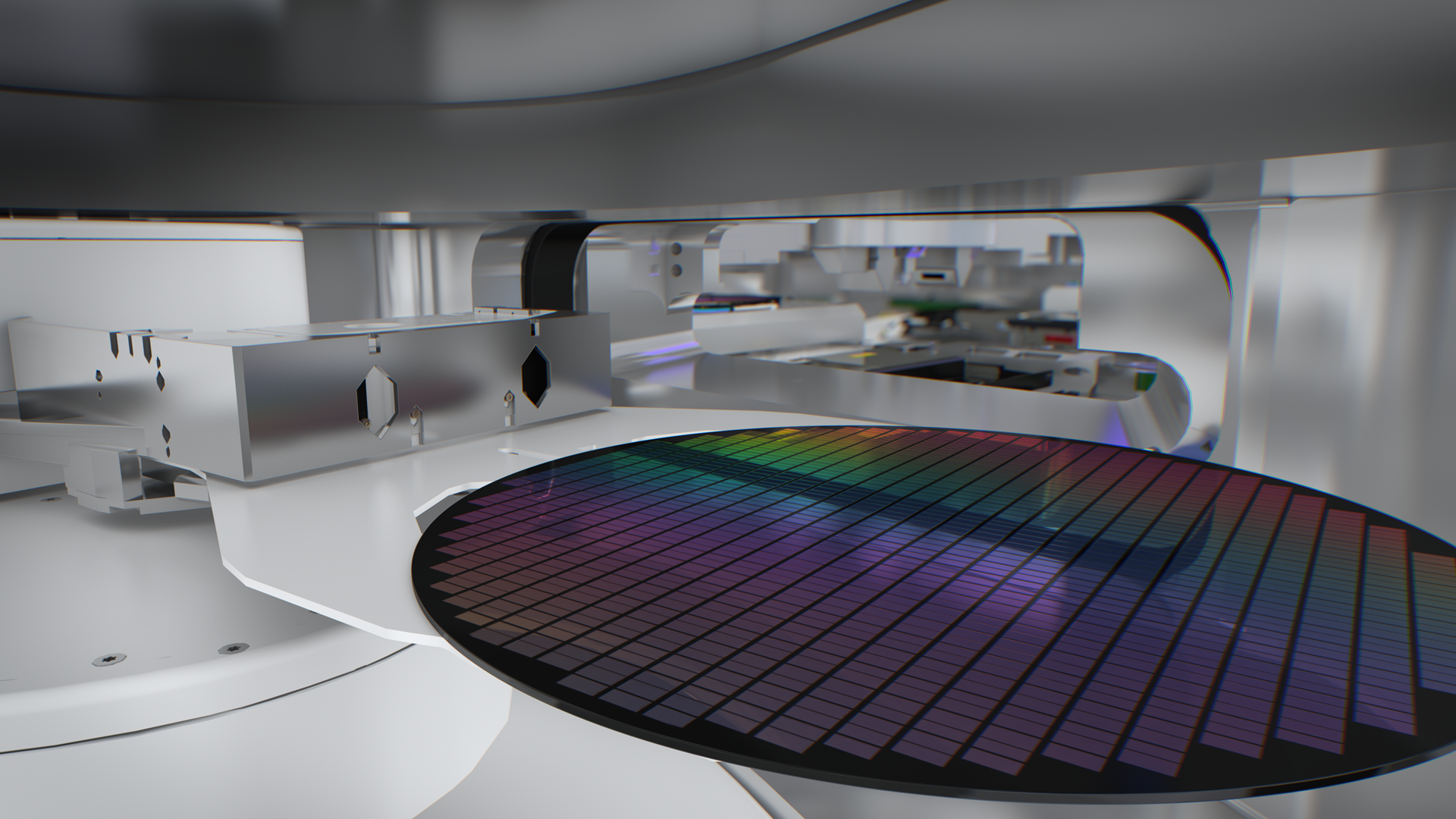

Shrink is a key driver, supporting innovation and providing long-term growth in the semiconductor industry.

But the industry needs the right tools in place to cost-effectively mass produce chip technology, especially as chip features continue to shrink.

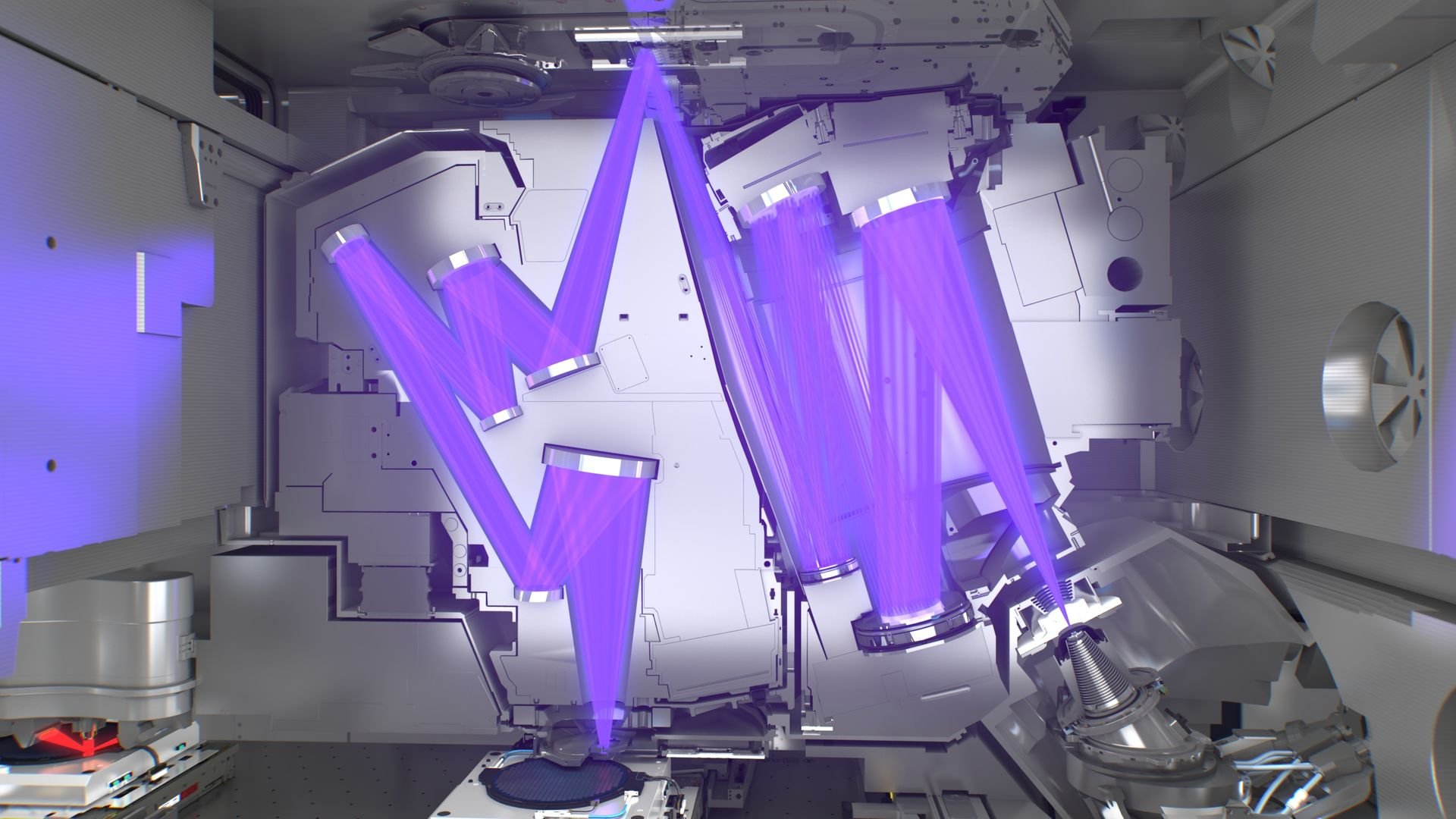

The transition from Deep Ultraviolet (DUV) to Extreme Ultraviolet (EUV) light has simplified the chip manufacturing process and reduced costs across the board in comparison to complex multi-patterning processes.

ASML has pioneered EUV lithography. Thanks to the higher resolution our machines achieve, chipmakers can now produce smaller, faster and more powerful chips while keeping costs in check.

Moore to explore

EUV industrialization is just the beginning of the next stage of our journey. Our product portfolio is aligned to industry trends and our customers’ detailed product roadmaps, which require lithography-enabled shrink beyond the next decade.

ASML will continue to explore many other opportunities in a range of areas that provide unique value drivers for our customers and our businesses.

Sustainability

Find out what sustainability means to us at ASML and what concrete actions we are taking together with our customers, suppliers and partners.

Focusing on M&A

We have completed several strategic and focused mergers and acquisitions over the past years to further support our growth and technological advancement as a company.

In 2001, we acquired the Silicon Valley Group, whose site in Wilton, Connecticut, US, is now a major R&D and manufacturing center.

In 2007, we acquired Brion, a US company specializing in computational lithography for integrated circuits. Brion's portfolio has since become a cornerstone of our Holistic Lithography product strategy.

In 2013, we acquired Cymer, a US manufacturer of light sources, to accelerate the development of the next-generation lithography technology EUV.

In 2016, we acquired HMI in Taiwan to further enhance our Holistic Lithography product portfolio with e-beam inspection technology.

In 2017, we acquired a 24.9% indirect interest in Carl Zeiss SMT GmbH in Germany to facilitate the further development of our EUV systems and align both companies in executing long-term roadmaps, including High-NA.

In 2020, we acquired Berliner Glas Group, a privately held manufacturer of ceramic and optical modules, which are important to support the future roadmap for our EUV and DUV products.