Press release - Veldhoven, the Netherlands, July 18, 2012

ASML Holding N.V. (ASML) today publishes 2012 second-quarter results.

- ASML on track for 2012 second-half sales between EUR 2.2 and 2.4 billion

| Q2 2012 | Q1 2012 | |

|---|---|---|

| Net sales | 1,228 | 1,252 |

| ...of which service and field option sales | 243 | 202 |

| New systems sold (units) | 42 | 47 |

| Used systems sold (units) | 2 | 5 |

| Net bookings, excluding EUV | 949 | 865 |

| Net bookings, excluding EUV (units) | 43 | 36 |

| ASP of booked systems, excluding EUV | 22.1 | 24.0 |

| Systems backlog, excluding EUV | 1,503 | 1,598 |

| Systems backlog, excluding EUV (units) | 55 | 56 |

| Gross margin excluding EUV | 43.2% | 43.3% |

| Gross margin | 43.2% | 41.8% |

| End-quarter cash and cash equivalents and short-term investments | 2,702 | 2,953 |

| Net income | 292 | 282 |

| EPS (in euro) | 0.71 | 0.68 |

| (Figures in millions of euros unless otherwise indicated) |

Outlook

“We executed H1 2012 as planned and expect sales to remain steady in the second half,” said Eric Meurice, President and Chief Executive Officer of ASML. “The second half revenue level is expected to be between EUR 2.2 billion and 2.4 billion and looks sustained by an increase of NAND memory critical layer systems shipments, stability of DRAM memory systems sales, and slower 28/32 nm Logic in the second half compared with the first half. The exact level of sales achieved in the second half will depend on the strength of NAND pick up, itself fueled by new ultrabook PCs and new smartphone ramps. On the technology front, we expect to ship the first of the NXE:3300, our production-capable Extreme Ultraviolet (EUV) system, by the end of this year or early next year and the rest of our 11 unit order in 2013. These tools will be used for process development. We are furthermore making progress in preparing EUV lithography for 2014 device production, evidenced by customer commitment to purchase four additional production systems for delivery in 2014. This commitment is enabled by the data gathered on source power increase and by steady performance of the six units already in the field,” Meurice said.

For the third quarter 2012, ASML expects net sales of about EUR 1.2 billion, gross margin of about 43%, R&D costs at EUR 145 million and SG&A costs at EUR 60 million.

Second-quarter 2012 highlights

- To date we have shipped 30 TWINSCAN NXT:1950i systems which can image 230 wafers per hours. In addition, we have started upgrading TWINSCAN NXT:1950i systems at customer manufacturing sites to this productivity level.

- A TWINSCAN NXT:1950i has exceeded the productivity milestone of more than 5,100 wafers in a single day at a customer manufacturing site, 600 wafers more than the previous record achieved three months ago, underlining the continuing productivity improvements of our platforms for high-volume chip manufacturing.

- As part of our Holistic Lithography portfolio, our computational lithography unit Brion delivered significant enhancements to its leading Mask 3D models and applications, which are required at the 20 nanometer node and below. The full accuracy of the Brion Mask 3D models can now be realized with virtually zero incremental computational cost versus substantially less accurate thin mask models.

- Customers have now exposed more than 15,000 wafers on the six NXE:3100 process development systems currently installed.

- We have exposed the first wafers on the NXE:3300B EUV scanners – the volume production successor of the NXE:3100.

- We have received customer commitment to purchase four additional NXE:3300 systems, raising the total to 15, as customers are accelerating development and preparing for first semiconductor device production on EUV systems in 2014.

- With regards to productivity of the EUV source, 50 watt power capability has been repeatedly demonstrated at a supplier and 105 watt concept potential has been confirmed in lab experiments, supporting our roadmap to volume production systems starting at 70 wafers per hour. In situ experiments on the NXE:3300 will however still be necessary for full confirmation.

- ASML has completed the expansion of the EUV cleanroom.

- On July 9, ASML announced a co-investment program in which customers will potentially contribute up to EUR 1.38 billion over the next 5 years to accelerate the development of 450mm wafer platform and the next generaton of EUV systems, expected to enter volume production in the second half of this decade.

Update on share buyback program

For regulatory reasons, in connection with the Customer Co-Investment Program announced on July 9, 2012, ASML has suspended its share buy-back program from July 10, 2012 until further notice. ASML intends to resume share buy-backs when permitted under applicable regulations.

In 2011 and 2012, ASML has purchased shares for a total amount of EUR 970 million as part of its intention to purchase up to EUR 1,130 million of its own shares within 2 years. All transactions under the buy-back programs are published on ASML's website.

Extraordinary General Meeting of Shareholders

Following the announcement of the Customer Co-Investment Program for Innovation on July 9, 2012, ASML will call an Extraordinary General Meeting of Shareholders (“EGM”) to be scheduled for September 7, 2012. The convocation for this EGM will be issued on, or about, July 24, 2012.

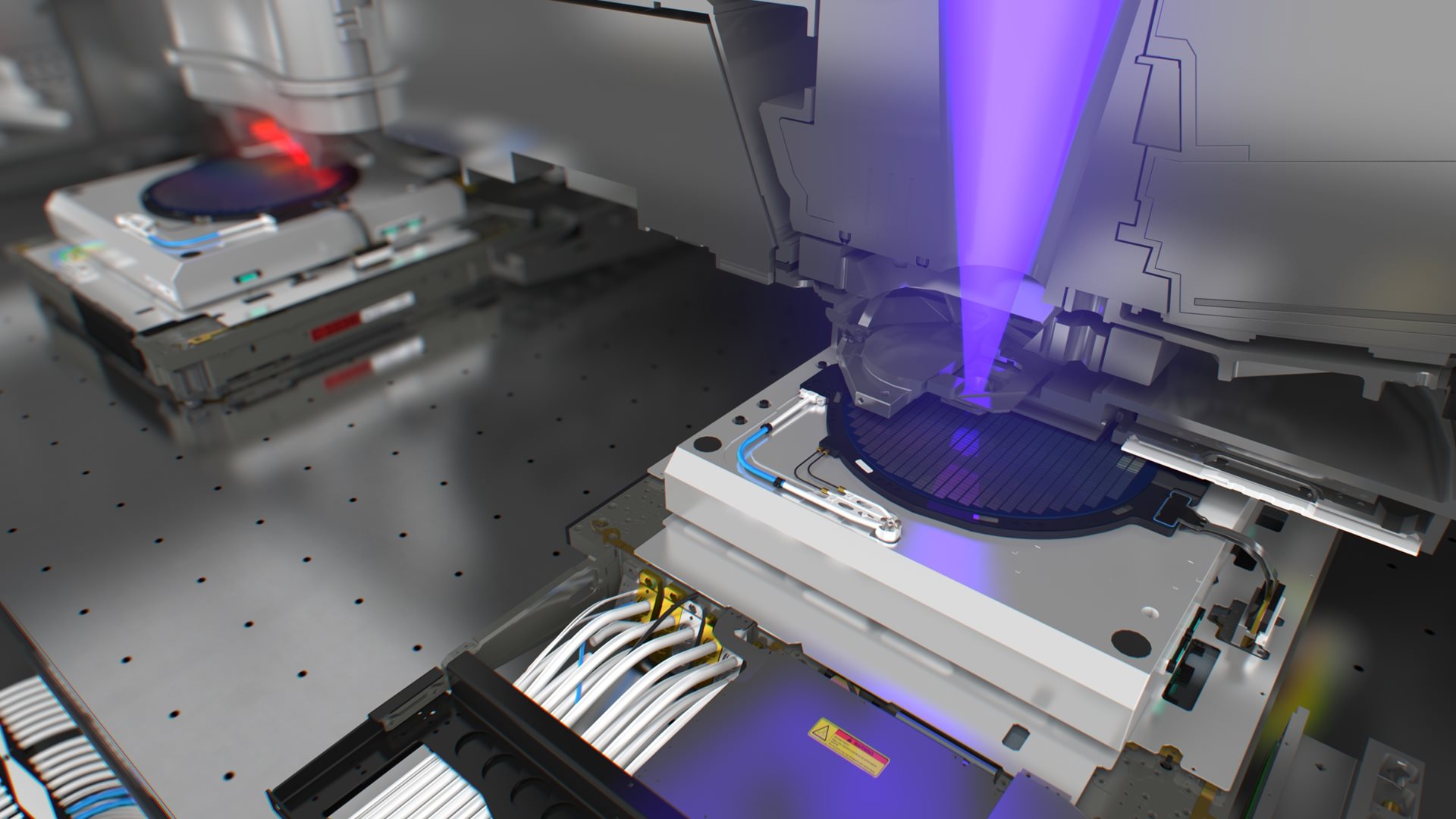

About ASML

ASML is one of the world's leading providers of lithography systems for the semiconductor industry, manufacturing complex machines that are critical to the production of integrated circuits or chips. Headquartered in Veldhoven, the Netherlands, ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML. ASML has more than 8,000 employees on payroll (expressed in full time equivalents), serving chip manufacturers in more than 55 locations in 16 countries. More information about our company, our products and technology, and career opportunities is available on our website: www.asml.com.

Investor and media conference call

A conference call for investors and media will be hosted by CEO Eric Meurice and CFO Peter Wennink at 15:00 PM Central European Time / 09:00 AM Eastern U.S. time. Dial-in numbers are: in the Netherlands + 31 10 29 44 290 and the US +1 646 254 3362 (US participants will have to quote the following confirmation code when dialing into the conference: 2604228). To listen to the conference call, access is also available via www.asml.com.A replay of the Investor and Media Call will be available on www.asml.com.

US GAAP and IFRS financial reporting

ASML's primary accounting standard for quarterly earnings releases and annual reports is US GAAP, the accounting standard generally accepted in the United States. Quarterly US GAAP consolidated statements of operations, consolidated statements of cash flows and consolidated balance sheets, and a reconciliation of net income and equity from US GAAP to IFRS as adopted by the EU are available on www.asml.com.In addition to reporting financial figures in accordance with US GAAP, ASML also reports financial figures in accordance with IFRS for statutory purposes. The most significant differences between US GAAP and IFRS that affect ASML concern the capitalization of certain product development costs, the accounting of share-based payment plans, the accounting of income taxes and the accounting of reversal of inventory write-downs. ASML’s quarterly IFRS consolidated income statement, consolidated statement of cash flows, consolidated statement of financial position and a reconciliation of net income and equity from US GAAP to IFRS are available on www.asml.com.

The consolidated balance sheets of ASML Holding N.V. as of July 1, 2012, the related consolidated statements of operations and consolidated statements of cash flows for the quarter ended July 1, 2012 as presented in this press release are unaudited.

Regulated information

This press release, the US GAAP consolidated financial statements, the IFRS consolidated financial statements and the Statutory Interim Report published on www.asml.com comprise regulated information within the meaning of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht).