Press release - Veldhoven, the Netherlands, February 6, 2013

ASML Holding NV (ASML) today announces that Cymer, Inc. (Nasdaq: CYMI) stockholders voted to approve the previously announced merger agreement, dated October 16, 2012, among Cymer, ASML Holding NV and certain affiliates of ASML, at the special meeting of Cymer stockholders held on February 5, 2013.

More than 82% of the shares outstanding and 99% of the votes cast at the special meeting were voted in favor of the merger agreement.

Completion of the merger remains subject to customary closing conditions, including expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Act and receipt of approvals under other foreign competition laws. Cymer and ASML continue to expect the transaction to close in the first half of 2013.

About ASML

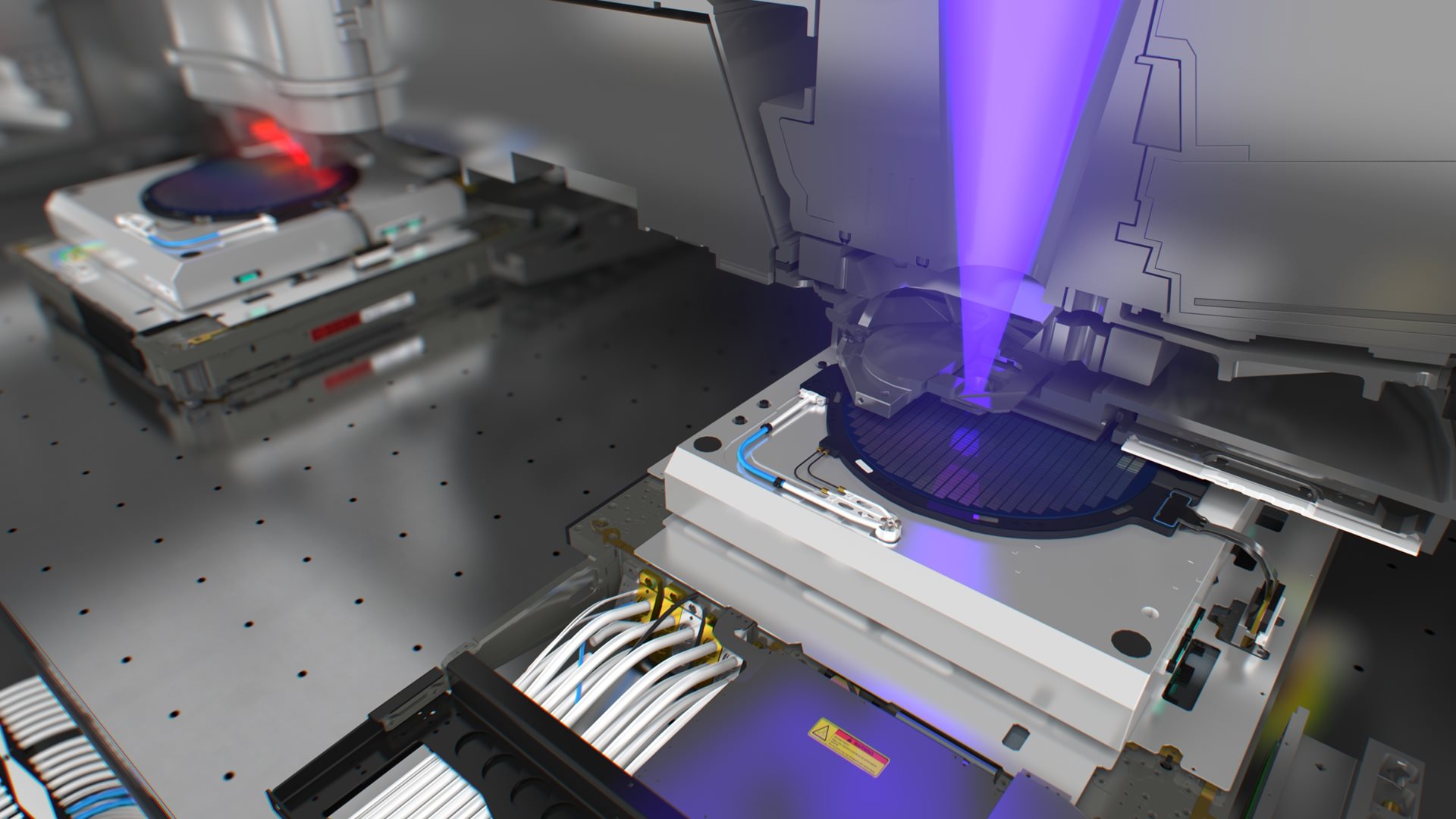

ASML is one of the world's leading providers of lithography systems for the semiconductor industry, manufacturing complex machines that are critical to the production of integrated circuits or chips. Headquartered in Veldhoven, the Netherlands, ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML. ASML has 8,500 employees on payroll (expressed in full time equivalents), serving chip manufacturers in more than 55 locations in 16 countries. More information about our company, our products and technology, and career opportunities is available on our website: www.asml.com.

Forward-looking statements

“Safe Harbor” Statement under the US Private Securities Litigation Reform Act of 1995: this press release contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements relating to the expected closing date of the Cymer acquisition. These forward-looking statements involve risks and uncertainties that may cause results to differ materially from those set forth in the forward-looking statements. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates, assumptions about future events, taking into account the information currently available to us, and readers should not place undue reliance on them. Actual results or developments may differ materially from those in the forward-looking statements. These forward looking statements are subject to risks and uncertainties, including, among other things, the inability to obtain regulatory approval for this transaction, the satisfaction of other conditions to the closing of the transaction, the possibility that the length of time necessary to consummate this transaction may be longer than anticipated.The foregoing risk list of factors is not exhaustive. You should consider carefully the foregoing factors and the other risks and uncertainties that affect the businesses of ASML and Cymer described in the risk factors included in ASML's Annual Report on Form 20-F and Cymer’s Annual Report on Form 10-K, Cymer’s Quarterly Reports on Form 10-Q, and other documents filed by ASML and Cymer from time to time with the SEC. The parties disclaim any obligation to update the forward-looking statements contained herein.