Press release - Veldhoven, the Netherlands, October 15, 2014

ASML Holding N.V. (ASML) today publishes its 2014 third-quarter results.

- ASML reports Q3 net sales of EUR 1.32 billion at a gross margin of 43.7%

- ASML guides Q4 net sales at around EUR 1.3 billion and a gross margin of around 43%

- ASML expects 2014 net sales of at least EUR 5.6 billion

| (Figures in millions of euros unless otherwise indicated) | Q3 2014 | Q2 2014 |

|---|---|---|

| Net sales | 1,322 | 1,644 |

| ...of which service and field option sales | 438 | 401 |

| Other income (Co-Investment Program) | 20 | 20 |

| New systems sold (units) | 24 | 27 |

| Used systems sold (units) | 6 | 4 |

| Average Selling Price (ASP) of net system sales | 29.5 | 40.1 |

| Net bookings, excluding EUV | 1,397 | 1,048 |

| Net bookings, excluding EUV (units) | 47 | 29 |

| ASP of booked systems, excluding EUV | 29.7 | 36.1 |

| Systems backlog, excluding EUV | 2,406 | 1,763 |

| Systems backlog, excluding EUV (units) | 65 | 46 |

| Gross profit | 578 | 752 |

| Gross margin (%) | 43.7 | 45.7 |

| Net income | 244 | 399 |

| EPS (basic; in euro) | 0.56 | 0.91 |

| End-quarter cash and cash equivalents and short-term investments | 2,685 | 2,711 |

A complete summary of U.S. GAAP Consolidated Statements of Operations is published on www.asml.com.

CEO statement

"We are on track to meet our full-year 2014 forecast of at least EUR 5.6 billion of net sales. In the third quarter, we delivered a good profit margin on net sales that fell just short of our previous guidance due to a couple of system shipments shifting into Q4, which does not impact our full-year guidance. Looking ahead, we see a solid start to 2015. In memory, we expect higher sales in H1 driven by the strong backlog. In logic, the ramp of 20/16/14 nanometer nodes is expected to continue, but the timing and volume depends on the business allocations by our customers' customers," ASML President and Chief Executive Officer Peter Wennink said.

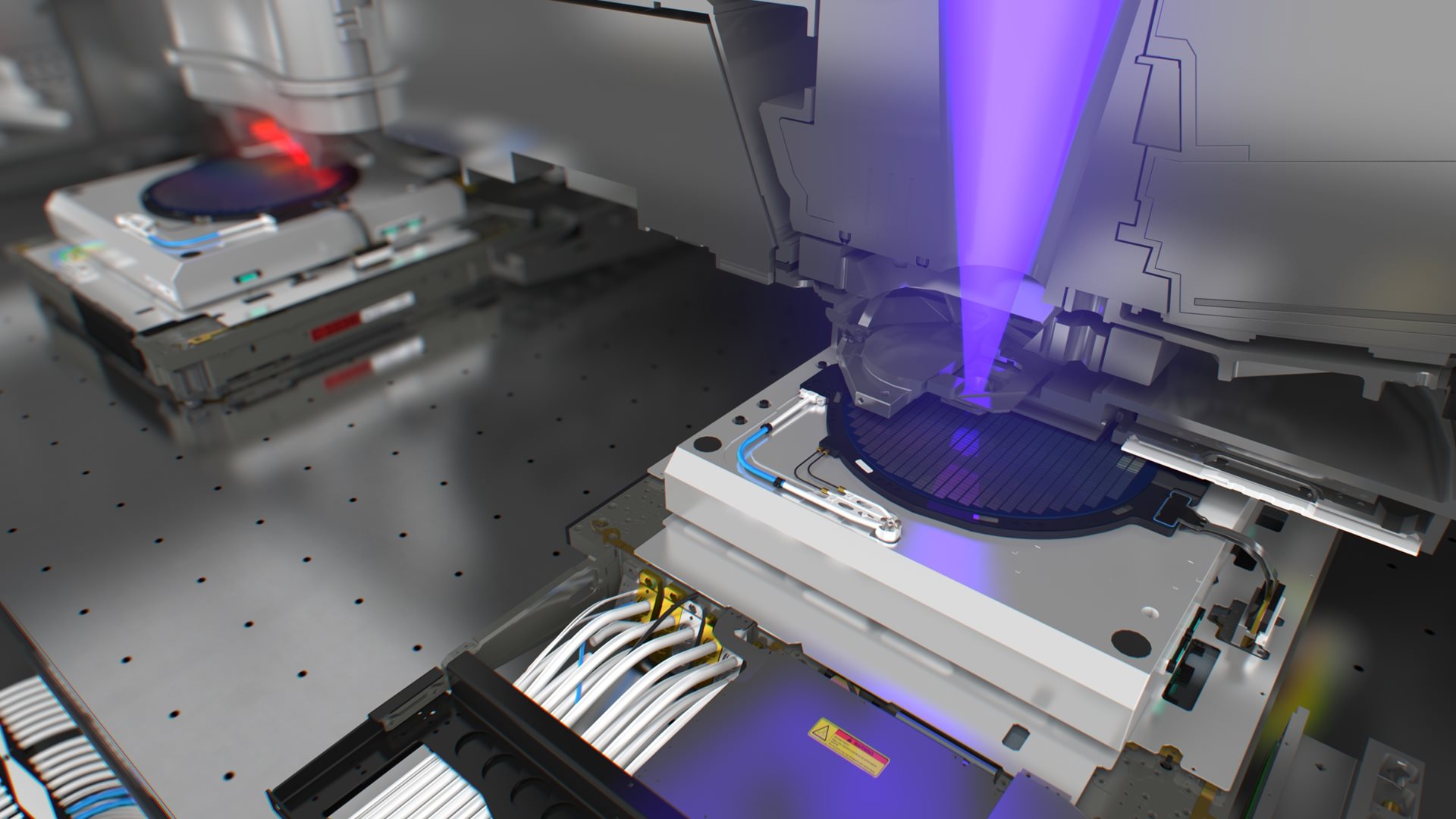

"Our EUV program showed substantial progress in the quarter. All installed NXE:3300B systems have been upgraded to a wafer processing capability of more than 500 wafers per day. Two customers conducted endurance tests that demonstrated this capability of more than 500 wafers in a 24-hour period. We continue executing programs that should consistently deliver this level of performance, which our customers require by the end of the year. As planned, we recognized two EUV systems in revenue in the quarter; another system started exposing wafers in October and will be included in Q4 sales. We are working with a customer towards a mid-node insertion of EUV at the 10 nanometer logic node expected in late 2016. Other customers are preparing for initial learning in a manufacturing environment. In this scenario we expect to ship around six NXE:3350B systems starting mid-2015, on top of the three NXE:3300B systems that will be converted to NXE:3350B configuration," Wennink said.

Product highlights

- We shipped 12 of our most advanced immersion lithography systems, the TWINSCAN NXT:1970Ci, bringing the total to 42 and marking our fastest ramp of any new major product; and customer recognition of the value offered by the scanner.

- A TWINSCAN system in operation at a memory manufacturer imaged more than 1.5 million wafers within one year, making it the second system to achieve that milestone.

- With 11 shipments in Q3, the YieldStar 250D is now in operation at all key logic and memory customers.

- Our integrated metrology solution, which substantially shortens metrology cycle time and enhances manufacturing yield through feedback loops, was released to high-volume manufacturing at a large foundry customer.

- To date, a total of six NXE:3300B EUV systems have been qualified and shipped, and all are exposing wafers. With regards to the total order for 11 NXE:3300B systems, three were shipped in 2013 (one system recognized in net sales in 2013, two in 2014), five have shipped or are expected to be shipped in 2014 (three systems will be recognized in net sales in 2014, one in 2015 and one is recognized as part of R&D); the remaining three systems are planned to be upgraded to NXE:3350B configuration in 2015 (timing of revenue recognition is dependent on timing of the upgrades).

Outlook

For the fourth quarter of 2014, ASML expects net sales of around EUR 1.3 billion, a gross margin of around 43%, R&D costs of about EUR 260 million, other income of about EUR 20 million – which consists of contributions from participants of the Customer Co-Investment Program – and SG&A costs of about EUR 80 million.

Update share buyback program

As part of ASML's policy to return excess cash to shareholders through dividend and regularly timed share buybacks, ASML has announced its intention to purchase up to EUR 1.0 billion of its shares in 2013-2014. Through 28 September 2014, ASML has acquired 11.8 million shares under this program for a total consideration of EUR 776 million. The repurchased shares will be cancelled. All transactions under the buyback programs are published on ASML's website. The share buyback program may be suspended, modified or discontinued at any time.

About ASML

ASML makes possible affordable microelectronics that improve the quality of life. ASML invents and develops complex technology for high-tech lithography machines for the semiconductor industry. ASML's guiding principle is continuing Moore's Law towards ever smaller, cheaper, more powerful and energy-efficient semiconductors. Our success is based on three pillars: technology leadership combined with customer and supplier intimacy, highly efficient processes and entrepreneurial people. We are a multinational company with over 70 locations in 16 countries, headquartered in Veldhoven, the Netherlands. We employ more than 13,800 people on payroll and flexible contracts (expressed in full time equivalents). Our company is an inspiring place where employees work, meet, learn and share. ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML. More information about ASML, our products and technology, and career opportunities is available on: www.asml.com.

Investor and media conference call

A conference call for investors and media will be hosted by CEO Peter Wennink and CFO Wolfgang Nickl at 15:00 PM Central European Time / 09:00 AM Eastern U.S. time. Dial-in numbers are: in the Netherlands +31 20 794 8485 and the US +1 480 629 9822 (no confirmation code needed). Listen-only access is also available via www.asml.com.

US GAAP and IFRS financial reporting

ASML's primary accounting standard for quarterly earnings releases and annual reports is US GAAP, the accounting principles generally accepted in the United States of America. Quarterly US GAAP consolidated statements of operations, consolidated statements of cash flows and consolidated balance sheets, and a reconciliation of net income and equity from US GAAP to IFRS as adopted by the EU (‘IFRS') are available on www.asml.com.In addition to reporting financial figures in accordance with US GAAP, ASML also reports financial figures in accordance with IFRS for statutory purposes. The most significant differences between US GAAP and IFRS that affect ASML concern the capitalization of certain product development costs, the accounting of share-based payment plans and the accounting of income taxes. ASML's quarterly IFRS consolidated statement of profit or loss, consolidated statement of cash flows, consolidated statement of financial position and a reconciliation of net income and equity from US GAAP to IFRS are available on www.asml.com.

The consolidated balance sheets of ASML Holding N.V. as of 28 September 2014, the related consolidated statements of operations and consolidated statements of cash flows for the quarter ended 28 September 2014 as presented in this press release are unaudited.

Regulated information

This press release, the US GAAP consolidated financial statements, the IFRS consolidated financial statements and the Statutory Interim Report published on www.asml.com comprise regulated information within the meaning of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht).